Professional Services

Dilapidations

Service Charge Associates offer consultancy services designed to successfully settle dilapidations claims at lease expiry. Having represented both landlords and tenants upon numerous claims, utilising extensive experience of lease interpretation, building fabric elements and M&E installations, we are well positioned to advise landlords upon the compilation of a justifiable claim or to act for tenants in defending a claim received.

Negotiating within the framework of The Dilapidations Protocol 2015, we are able to achieve the most cost effective settlement for the client.

Furthermore, drawing upon extensive project co-ordination experience, Service Charge Associates can also specify, tender and manage completion of works on behalf of tenants to mitigate, and in some instances eliminate, their dilapidations liability.

Project Co-ordination

Service Charge Associates are able to offer Project Co-ordination skills to landlords and tenants on projects as diverse as stone cladding repairs to chiller replacements. We have in-house design and management experience relating to both building fabric elements and mechanical and electrical installations.

Projects may start with a feasibility study, which will consider the possible options and estimated costs. We can then move on to specification writing, competitive tendering, tender reporting and placement of orders with contractors, dependent on the needs of the client.

During the on-site phase, we provide liaison between the contractors, client and occupiers, ensuring that the works are completed with the minimum of disruption, on time, and to budget. We ensure that the works are compliant to specification and timely final accounts are issued. We then monitor the completed works through the defects liability period.

We often look for innovative solutions using our vast experience of working within the construction and building services industries. Where relevant, we can act as CDM (Construction Design & and Management) Principal Designer.

Planned Maintenance Advice

Maintenance of M & E plant is essential to maintain operational performance and efficiency, longevity and optimum use of energy.

At Service Charge Associates we can undertake an in depth review of your maintenance requirements, including existing contracts, compile / review Planned Preventative Maintenance {PPM} programmes, and carry out in depth surveys of plant to ensure that it is being maintained and operated in the most efficient manner.

We can also undertake contract re-tenders, M & E dilapidations surveys, together with feasibility and energy reports.

Our main aim is to reduce your on-going costs, and energy usage, whilst maintaining or where possible, improving the operation of the services and extending the longevity of the plant.

Our building surveyors can also undertake building fabric condition surveys and prepare planned maintenance schedules to ensure that the cyclical and one-off repairs and maintenance work are undertaken at the appropriate intervals.

Energy Assessment

Service Charge Associates carry out surveys of building services plant and equipment to ensure the optimum use of energy and the most competitive tariffs are being charged.

Our aim is to reduce your energy usage, whilst maintaining or where possible, improving the operation of the services.

Where appropriate, the following checks can be undertaken:

An in-depth survey of the operation of the Building Management System (BMS) to ensure it controls all devices efficiently.

A review of temperature set points and plant operating times at the building.

Measure the operational efficiency of boilers, chillers, lifts and ventilation plant, which are high energy-consuming equipment.

An assessment of the lighting controls and lighting types in order to ensure best practice and optimum energy efficiency.

Evaluate existing energy contracts including re-tenders and review of tariff rates to ensure value for money.

Following an inspection, we will make recommendations to reduce your energy bill or the potential for sustainable energy and resource management, such as rainwater harvesting, ground source heat pumps or other renewable energy source.

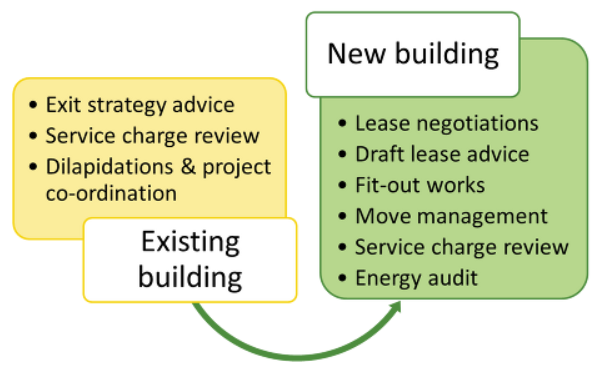

Transition Management

Service Charge Associates are offering a "one stop shop" service to assist tenants through the minefield of property matters businesses face when coming to the end of a lease, including:

Lease end service charge management

Dilapidations & project co-ordination

Agency advice to find new premises

Due diligence

Design & management of fit-out works

Move management & procurement of services

Lease, service charge and energy assessments

The TMS process ideally starts two years prior to your lease end date, but can be commenced at any stage along the process.

Rent Collection

Whether working for Landlords or tenants with sub-let space, Service Charge Associates manage the rent collection activities to ensure that the correct amounts are invoiced, collected and accounted for from your tenants.

We review leases to ensure that the rents are properly raised, service charges recovered and insurances procured, as appropriate. We are registered with and audited by RICS Regulation and subscribe to the Client's Money Protection Scheme for your peace of mind.

We use our bespoke property management software to manage a client ledger, track invoices, manage debtors, document transactions and provide financial reporting. Because our systems are bespoke, we can adjust the format of outputs to meet your own reporting requirements.

When service charges are passed through to sub-tenants, the amounts differ from year to year. If there is a service charge cap, the amount invoiced by the landlord may not be the appropriate cost to recover from sub-tenants. These differences can often lead to an under recovered amount if not adjusted appropriately.

Service Charge Associates can audit the amounts collected from the start of the lease for: rent, service charge, electricity, insurance or any other recoverable costs to ensure that any unrecovered amount is identified, fully explained to the tenant and sub-tenant prior to recovery.

Property Management Support

We provide assistance to landlords and managing agents with a range of services to assist with the management of service charges. These include:

Service charge set-up

Lease analysis

Prior year assessments of sums recovered

Service charge budgeting

Service charge certification

Planned maintenance / lifecycle planning

Rent collection

Insurance procurement and reinstatement valuations

Debtor control

Financial reporting

Compliance auditing

Capital Allowances

What are Capital Allowances

Capital Allowances is a form of tax relief which provides a cash benefit by reducing the amount of tax payable against income for individuals or profits for businesses. The tax relief is available for certain property expenditure, such as: Second hand property acquisitions, fitting out property, refurbishment of existing property, extensions to existing property and new build developments.

The Benefit of Capital Allowances

The tax relief claimed creates a cash saving and can be viewed as reducing the cost of those qualifying property assets. For example:

Typical office refurbishment: £200,000

Eligible expenditure for Capital Allowances: £160,000

Tax Cash Saving based on 19% Corporate Tax Payer: £ 30,400

Net cost of the refurbishment: £169,600

The full tax saving is often taken in the year of expenditure, providing a significant cash flow advantage for clients and individuals alike.

Working with Veritas Advisory, we are able to identify and value qualifying Capital Allowances and often work alongside clients and their accountants to ensure this valuable tax relief is fully maximised. We will prepare individual claim reports on the client’s behalf, (even where the base cost information is limited) and agree the claim with HMRC.

Contact Service Charge Associates if you have previously incurred capital expenditure on property over the last 10 years or are planning capital expenditure for which it would benefit having an initial tax planning conversation with our Capital Allowances Specialist.

Portfolio Review

If your company has expanded due to a merger or acquisition or you are looking to reduce overheads by removing excess space, we can assist in consolidating your portfolio by providing you with analytical information and advice about your portfolio.

We review leases, analyse occupational costs and review how well each building fits with your business requirements.

Our experience in reviewing property costs and understanding how buildings operate provide us a unique perspective on which buildings would offer the best environment for your business.

We can provide benchmarking and comparative analysis across your portfolio to identify which buildings perform and serve your needs and which buildings should be relinquished. We advise on lease exit strategies, move management, space planning and many other ways to improve on occupational efficiencies.

No matter how large or small your portfolio, contact us today to discuss your requirements.

Insurance Benchmark

Working with brokers and underwriters, Service Charge Associates can review, prioritise and benchmark your insurance portfolio to identify high insurance premiums, review cover and seek reductions to your renewal premium.

Whether you have a portfolio of buildings or a single building, we can assess whether the insurance premium is reasonable. A benchmark quotation can demonstrate that significant reductions are possible and provide a robust basis for a reduction to the charges either by taking the benchmark quote or by negotiating with the landlord’s existing provider.

The extent of saving potential depends upon many factors, such as types of property, size, location and the number of properties within the portfolio. Upon initial discussion and review of a list we will be able to provide some targets and estimates as to achievable against provisional timelines.